Storefront Groups in USA Outsourced Accounts Payable Services for Stronger Vendor Relationship Outcomes

Outsourced accounts payable services in the USA help manufacturers strengthen payment cycles and reduce delays.

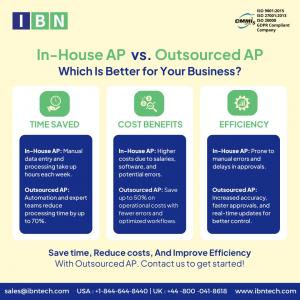

MIAMI, FL, UNITED STATES, July 8, 2025 /EINPresswire.com/ -- Retail storefront groups serving diverse markets in the U.S. are enhancing financial operations by adapting backend management models. To better handle fluctuating order volumes and growing payment complexities, many retail groups have decided to outsourced accounts payable services, enabling a smoother operational setup that supports vendor clarity and payment transparency.The accounts payable process is now handled in sync with financial control targets through vendor-led audits, automated validation, and scheduled payouts. By relying on firms skilled in retail finance support, such as IBN Technologies, these businesses are achieving better documentation standards and supplier accountability. The ability to stay audit-ready while managing fluctuating payables has helped finance managers reallocate focus toward value-centric planning, reducing invoice pileups and duplication errors in procurement chains.

Reduce errors in payment cycles and reconciliations

Get a Free Consultation: https://www.ibntech.com/free-consultation-for-ap-ar-management/

Retail Vendors Demand Consistency

Higher input prices, rising rent, and wage surges are cutting into retail earnings. Businesses relying on traditional accounts payable workflows are finding it harder to support fast billing reconciliation and maintain timely vendor relationships.

▪ Delays in approvals restrict vendor inventory restocks

▪ Errors in invoice-to-order matching impact payout trust

▪ Paper-heavy workflows fail under surge periods

▪ Payables remain untracked during remote store reporting

▪ Vendor term compliance gaps lead to disputes

▪ High staff hours consumed by simple reconciliation

▪ Late payments limit access to favorable supplier terms

▪ Reports vary between regional and corporate teams

▪ Errors in statements increase financial exposure

▪ Surges overwhelm teams during holiday months

To stay financially responsive, many finance departments are bringing in external support trained in large-scale AP execution. Working with providers that deliver structured AP workflow support, retailers now outsourced accounts payable services to improve billing accuracy, speed up supplier coordination, and maintain oversight during rapid market fluctuations.

AP Clarity for Retail Chains

Payment delays, inconsistent reconciliations, and missed vendor deadlines have prompted retail executives to rework AP management. Expert-led partnerships help teams eliminate backlogs, maintain payment discipline, and reduce duplication of reporting.

✅ Timely invoice reviews with guaranteed vendor compliance support

✅ Consolidated payables across all storefront and warehouse locations

✅ Verified invoice matching with digitized internal approval workflows

✅ Continuous visibility over pending and processed payment records

✅ Improved vendor relations through reliable transaction cycle monitoring

✅ Unified access to tax, audit, and ledger reconciliation documents

✅ Flexible support for high-frequency and short-term vendor billing

✅ Statutory compliance maintained throughout procurement documentation

✅ Strategic reporting tailored for financial clarity and operational review

✅ Industry-trained AP process experts delivering consistent results

Retail leaders are rethinking internal strain by choosing partners that enable smoother operations. Many companies opting for outsourced accounts payable services in Texas are finding increased accuracy and efficiency. Firms like IBN Technologies are helping streamline procurement cycles with financial expertise and structured vendor alignment.

Retail AP Efficiency in Texas

Retailers throughout Texas are enhancing finance operations through better payables structure and reduced bottlenecks. Strategic partnerships and outsourced accounts payable services deliver clearer financial paths and real-time vendor clarity, especially with experts like IBN Technologies.

● Invoice turnaround accelerated by 40%

● Manual review replaced by tiered validation framework

● Supplier updates improved through structured payment schedules

With IBN Technologies offering retail-focused guidance, finance leaders are improving operational agility and payout accuracy. Those using outsourced accounts payable services in Texas are now realizing more dependable vendor terms and improved cycle predictability.

AP Systems Modernize Retail Operations

Retailers are actively transforming their financial back-end to support the scale and speed required in today’s competitive retail environment. Multi-store chains are focusing on consistency in vendor payments, invoice timing, and compliance handling as they expand inventory flow across regions. Internal AP processes, once sufficient for small-scale operations, are now being redefined with strategic oversight and digital structure. Finance leaders are committed to improving accuracy while reducing the risks of manual oversight and payment delays. With more invoices moving faster than ever, businesses are rethinking how to ensure continuity and transparency in accounts payable systems.

Retailers who outsourced accounts payable services are seeing sharper execution in handling high volumes and better control over deadlines. Alongside this shift, conducting frequent Accounts Payable audit reviews is helping finance departments eliminate duplication and maintain accurate records across systems. Together, these steps create stronger documentation, improve vendor trust, and offer real-time financial visibility to leadership. Working with firms such as IBN Technologies, many are gaining structured AP workflows tailored for scalability, peak season handling, and retail-specific reporting needs. As these systems mature, companies are finding a measurable improvement in decision-making, vendor alignment, and payment precision—all driven by expert-backed, outsourced AP structures.

Related Service:

Outsource AP/ AR Automation Services: https://www.ibntech.com/ap-ar-automation/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

email us here

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Retail

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release